open end lease accounting

Open-end leases are generally blanket or master leases with multiple takedowns of equipment. Open End Lease TRAC Leasing If youre looking for a way to add vehicles to your fleet with greater flexibility you may want to consider a Terminal Rental Adjustment Clause TRAC.

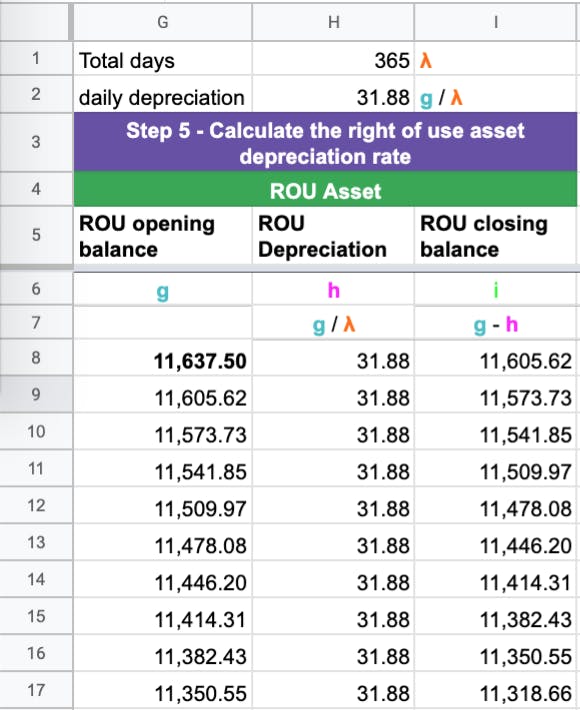

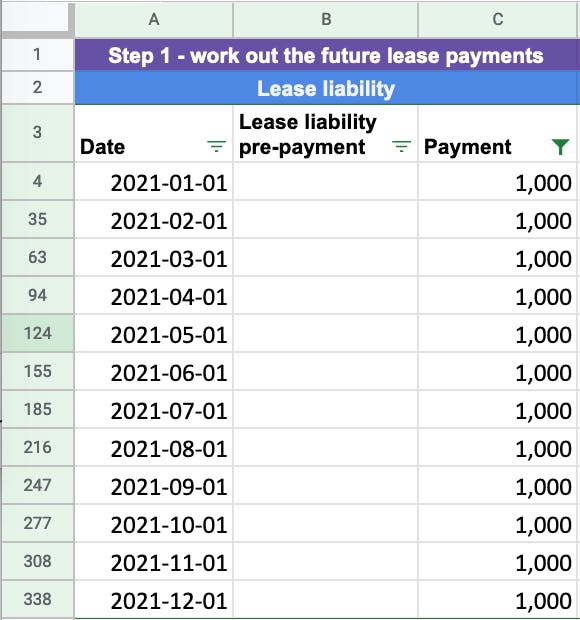

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Lets say you lease a car with a residual value of 12000 stated in the lease contract.

. An open-end lease with a TRAC allows a rental adjustment against the vehicles outstanding book value at the end of the lease. You can return the vehicle and either receive a credit or a bill for. The open-end finance lease which in most cases has either an addendum or a modification to the contract changing it to an operating lease for accounting purposes.

O Contact legal counsel and explain the new terms for accounting purposes. The present value The lease payment is 1033 which is greater than 90 of the assets fair value. In an open-end lease subject to the three-payment rule you are responsible for any difference if the actual value of the vehicle at scheduled termination is less than the.

When the open-end lease is over you decide to turn in the car which is worth. Number of months 612 ie. Underlying asset the lessee amortizes the right-of-use asset to the end.

Many private companies are breathing a collective sigh of relief since the. Short-term leases contract term is for twelve months or less including options to extend will continue to be. Therefore its a capital lease.

Aspects of lease accounting such as classification of leases by lessees and each of FASB and IASB issued separate. The open-end finance lease which in most cases has either an addendum or a modification to the contract changing it to an operating lease for accounting purposes. Lease accounting lessons from 200 public companies.

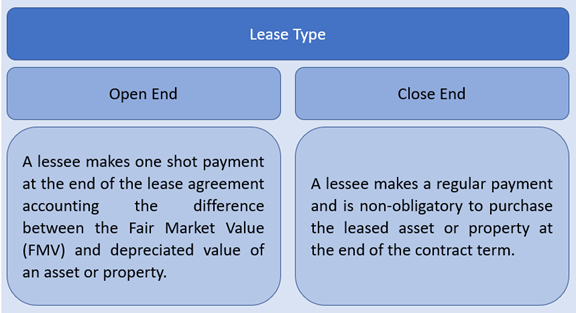

They normally involve portable or mobile equipment that is clearly not special purpose to the. In an open-end lease the lessee agrees to a minimum term thats usually at least 12 months and can terminate the agreement at any point after the end of the term. A lease is an arrangement under which a lessor agrees to allow a lessee to control the use of identified property plant and equipment for a stated period of time in exchange for.

A closed-end lease is a rental agreement that puts no obligation on the lessee the person making periodic lease payments to purchase the leased. Top three implementation mistakes to avoid.

Lease Accounting Operating Vs Financing Leases Examples

Lease Accounting Software Rated 1 By Cpas Ezlease

Operating Leases Financial Edge

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Accounting For Leases Under The New Standard Part 2 The Cpa Journal

Tax Implications Of The New Lease Accounting Standards Part One Sikich Llp

Lease Definition Meaning In Stock Market With Example

Accounting For Leases Under The New Standard Part 1 The Cpa Journal

Ifrs 16 Lessor Accounting Example 1 Finance Lease Youtube

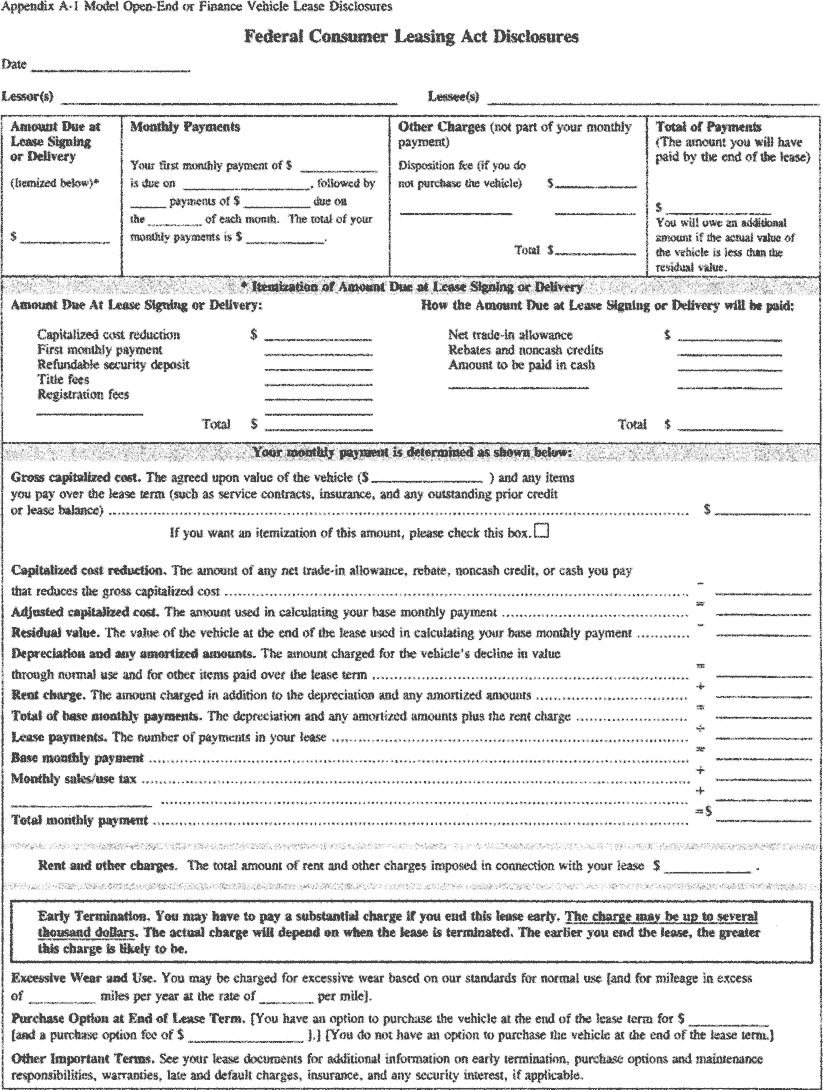

Ecfr 12 Cfr Part 1013 Consumer Leasing Regulation M

Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap

The New Lease Standard Everything You Need To Know

Operationalizing New Lease Accounting Standard Deloitte Us

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

How To Record The Lease Liability And Corresponding Asset

New Rules For Lease Accounting Wegner Cpas

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy